Falling in love with a start-up is like walking a tightrope. Like a high-wire artist, I can lose my balance and literally fall at any second. It is an unusual feeling.

I am fascinated by the process of conviction building and the psychology it demands. Interestingly, it is not often discussed nor it is easy to find useful content on this subject. But believe me, falling in love with a startup is central to being a VC and it is a very hard thing to do. In my case, it took me 14 months and ~400 dates (startups) to actually fall in love for the first time. It sounds completely crazy and I remember perfectly the time and the place when it happened and I experienced my first “aha moment”. It felt like some sort of initiation because in a heart-to-heart conversation with one of the Partners of my fund, he told me: “don’t worry, you will feel it deep down when you find the right startup”. He was right.

Like love, conviction building process is very personal to each investor. The objective of this piece is not, therefore, to offer a universal framework but to reflect and gain clarity on my conviction building roller coaster🎢 . I will add that hopefully by showing the behind the scenes to entrepreneurs, they will be able to use it to their advantage when raising a round of financing. 🤞.

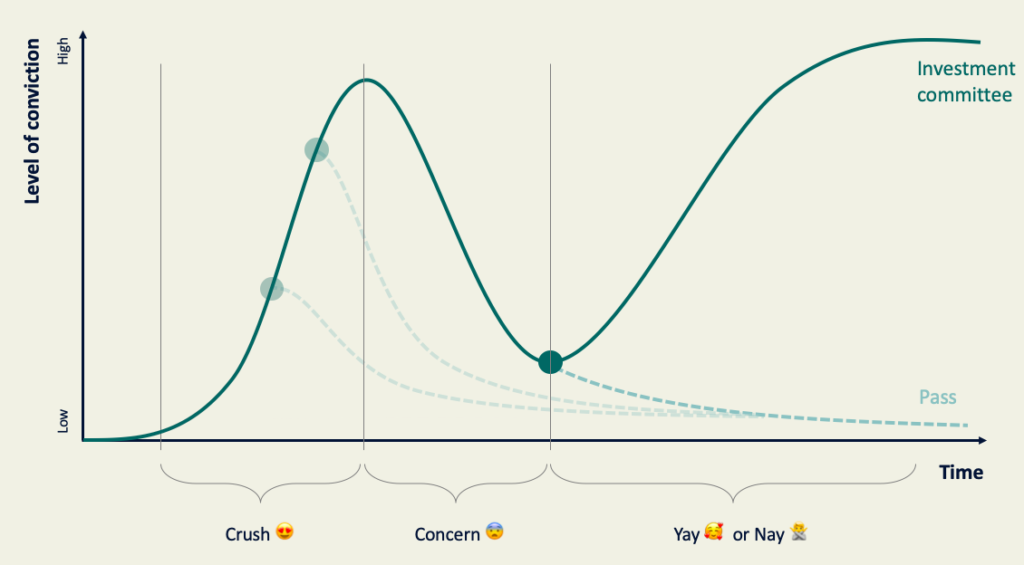

The process: three stages

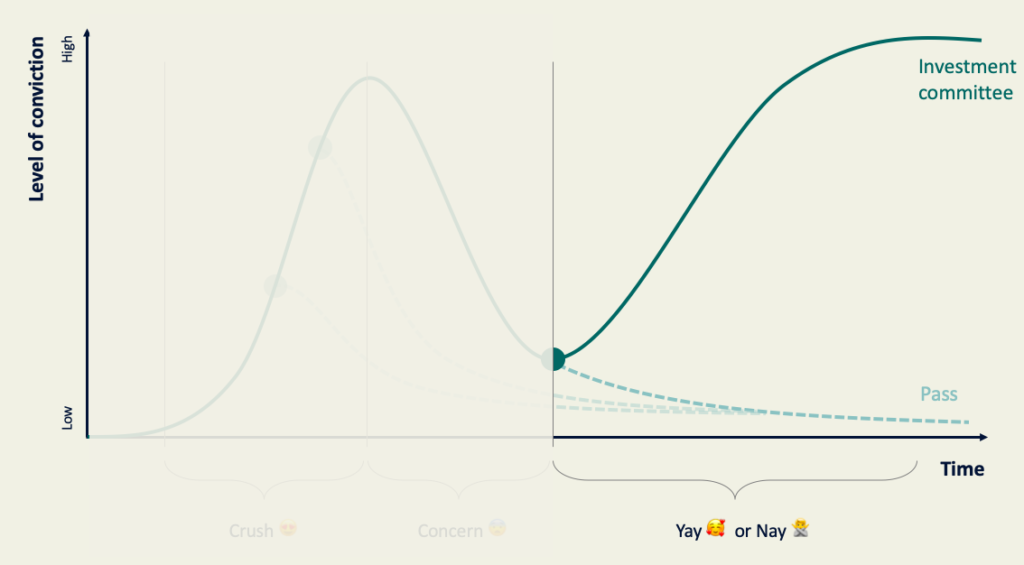

We can split the whole process into three phases, which leads me to honestly answer the main question:

“Do I have enough conviction to take this startup to the Partners and the investment committee?”.

(Or 😬 “Am I in love and ready to introduce her/him to my parents?“)

I have witnessed that the three phases (Crush 😍, Concern 😨, Yay 🥰 or Nay 🙅). Each is equally important because each contains a series of key sub-questions that support my ultimate question. (Note: Credit goes to Ben (Brighteye Partner) for helping me to name this second phase name “Concern 😨”)

Let’s analyse each phase in detail.

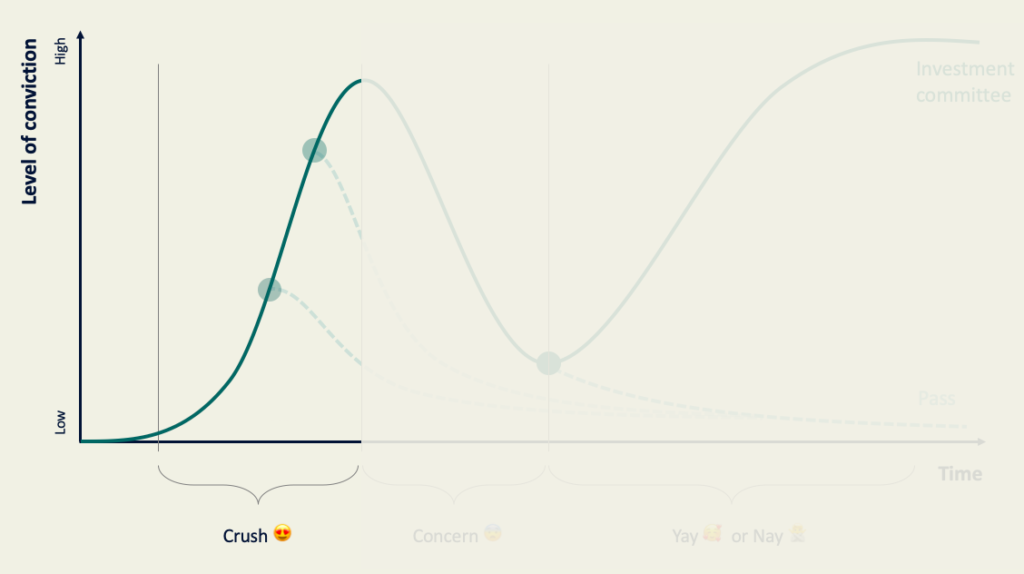

Phase 1: Crush 😍

In this discovery phase, I am super intrigued about the genesis of the company, its market and vision, I tend to fall in love really quickly with specific elements such as the team, product(s), or the go-to-market strategy. To me, it is critical to feel some sort of connection with the mission and the founders. I know it is a lot – I’ll give you that 😏. At this stage, I have observed that every single interaction I have with the founding team builds on the previous one, intensifying the crush. Essentially, I am looking to strengthen my own judgment about the potential of the company by asking myself:

1. Is it a VC play that fits in with Brighteye’s criterion? (i.e. Is it really my ideal type?)

Note: to assess the potential fit, you must consider a series of different factors, including (1) traditional VC factors like traction, team, market size, product-market fit, etc. and (2) others that you can’t control, such as portfolio diversification strategy, lifespan of the fund, dry powder availability, team beliefs and so on.

2. Do I picture myself working alongside the team and helping them in any way I can to build a great business? (i.e. Do we have chemistry? Do we have fun when spending time together?)

3. Is it aligned with my personal belief(s) and thesis(es) on this specific market? (i.e. Do we have similar values and takes on life?)

4. Do I feel a strong connection to the team, vision and/or product(s)? (i.e. Do I feel physically attracted?)

If the answers are all positive, my level of conviction intensifies and I begin to feel the butterflies in my stomach, my heart is in the game now. I want to do nothing but extensively read about the market, dig into competitors, listen to experts’ podcasts, and chat with industry experts and other investors to validate hypotheses and doubts that I have about the company and/or market. This is like telling all your friends about her/him and showing them her/his photos.

Sometimes I trick myself and I am blinded by the excitement because I focus on the strengths and things that I really like about the startup. This is especially true if the entrepreneurs have also indicated an interest in working with Brighteye. It’s like when the other person is clearly showing signs of mutual interest. In some cases, I even idealise the startup and fantasise about the things that I wish were true about the company but actually aren’t. Clearly my rational thinking is put on hold as I am falling in love.

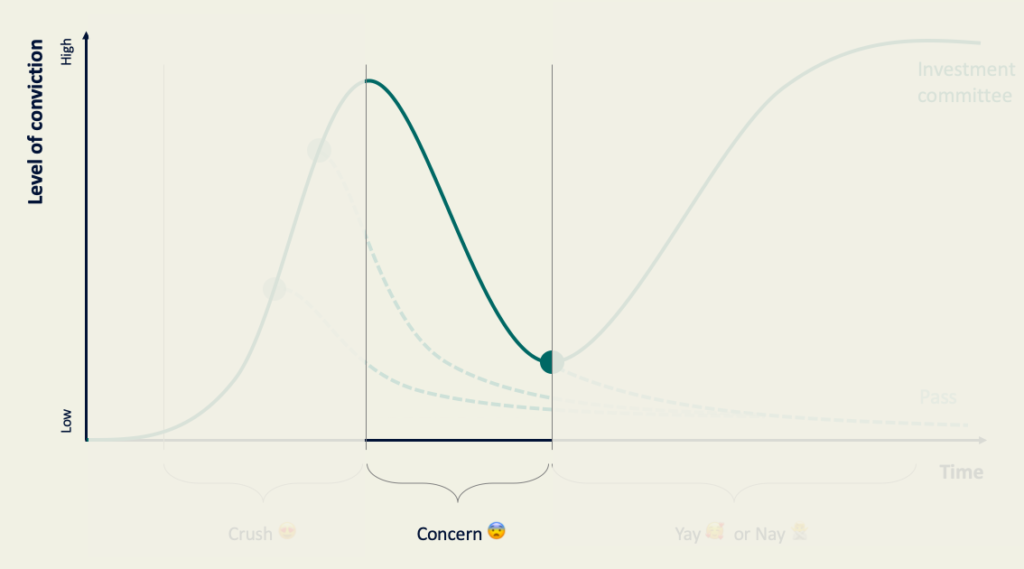

Phase 2: Concern 😨

Now that I am really into the company, here comes the fun part 👻. This is this special moment when I realise that the company has flaws – like everything else – and the excitement starts to fade. The level of conviction fades with it. This might be caused by several factors, maybe the rest of the investment team is not as excited as you are about the opportunity or you discover a new piece of information that affects your judgement, something off-putting happened during the interactions with the founders.

At this point is that rational thinking takes over to question the validity of my initial judgment and the reasons that got me excited and made me fall for this startup in the first place are put on trial. These are the types of questions that often arise:

- Is this the right company to bet on? (i.e. Is she or he “the one”?)

- Competitors look strong, does the team have what it takes to compete? (i.e. What if I meet someone else?)

- Does the startup have a long-term competitive moat? If so, what is it really? (i.e. Will they make a good serious partner?)

- Is it a must-have or nice-to-have solution? (i.e. Is it like or is it love?)

- What if they can’t scale? (i.e. What if we have no future?)

- Etc.

I start to see the risks associated with the potential investment and need to evaluate if we (founders & my fund) can go the distance. I believe it is some sort of natural defense mechanism that comes into play to make sure that I ask myself the hard questions (i.e. reasoning from first principles) about our compatibility. At this point, I break down the company into several elements (i.e. vision, go-to-market strategy, market structure, value proposition, execution skills of founders, etc.), dig deeper into specific elements before putting them back together.

The main challenge in this phase is to be able to take a step back and analyse the company from first principles without being influenced by others, by past experiences, analogies, conventional wisdom and other factors. I need to switch from the irrational love side of the brain to the cold hard facts. Boiling things down to the most fundamental truths of the company, this helps see the opportunity with fresh eyes and avoid falling into a trap of preconceptions, which in turn will prevent you from seeing the real opportunity. It is a very hard thing to do but I am convinced that it is key if you want to become an excellent investor, hence the reason I am trying to learn as much as possible on first principle thinking.

Ultimately, I should be able to answer the following sub-question:

“Do I strongly believe in the founders, the vision and the company?”

or “Am I really in love?”

Note: I have to admit that the founders’ energy and general behaviour in this phase play a crucial part.

Phase 3: Yay 🥰 or Nay 🙅

In VC, the sun doesn’t always come out after the rain. The third and last phase is the inflection point that comes down to answering the main question

“Do I have enough conviction to recommend (and defend) this investment to the rest of the team and the investment committee?”

Or “Am I ready to introduce her/him to my parents?”

This is a big step: it sends clear signals that it’s getting serious.

This phase is the most important one for me so let’s try to understand what influences the final answer to the main question. It is a function of

(1) the information that I have consumed

(2) the knowledge that I have of the market and trends

(3) the relationship that I have built with the founders

(4) the feelings that I have developed in the two previous phases

(5) my understanding of the fundamentals of the company.

It usually takes a few days of thinking and weighing everything to honestly answer the main question.

(6) And interestingly, there is an additional sixth variable that comes into play and that I haven’t mentioned yet: your reputation.

Let’s dig into the reputation variable because in the VC world, reputation is of essential importance as it will drive your future success. If you have a good reputation, you get access to high quality deals. However, the opposite is also true. This variable is paramount because bear in mind that most VC funds have investment committees (IC), usually composed of Partners and sometimes external advisors (depending on the fund structure). The IC approves or rejects investment proposals. By recommending an investment to the IC, you, as a VC, you put your reputation on the line. For instance, if the investment proves to be a success, you will earn trust from the partnership. If the investment is not a success, well you will lose credibility from your Partners. Note: IRL it is not as black and white when it comes to earning or losing trust, especially since in terms of deal volume, VCs generally lose more bets than they win, but I think you get the point that I’m trying to make here.

Let’s assume that the answer to the main question “Do I have enough conviction?” or “Am I in love?” is yes 👍. The next step is to sell that deal internally to the rest of the team in order to take it to the IC. Basically at this point, I will need to argue for our investment case with a bunch of very smart, experienced people (i.e. Partners) who tend to have strong and informed opinions on a myriad of topics. The argumentation process sometimes will go my way and sometimes it will go against me. It is generally tough but I am convinced that it is a necessary exercise because (1) the true level of conviction is put under scrutiny, and (2) it ensures that, as investor, you are seeing the full potential and risks of the investment with open eyes. Whatever the final outcome is, it is important to accept it; even if it hurts. If the investment proposal is rejected, often there is a difficult grief process that starts but that is part of the game too. 😊

Conclusion

VC is usually described as the “most creative part of the finance world” and I believe more than ever that it is an accurate description. VC is definitely more an art than a science and going through my very own conviction building process proves this to me.

As I mentioned at the beginning, the purpose of this essay was personal as I wanted to go a bit deeper in order to get a glimpse of what is really happening inside a VC’s brain. I am still impressed by the endless number of different factors that come into play during the whole process and ultimately influence the final decision. There is clearly no such thing as the perfect conviction building process but understanding how it works is paramount. I am also conscious that my process will evolve over time.

I hope that this short journey helped shed some light on the VC psychology.

As always, I would love to receive your feedback and understand whether other VCs are experiencing a similar process or a completely different one. 🙏