“How much equity should we give to our new CMO/CFO/etc.?” This is a tricky question that comes up often with early-stage founders as the company grows and hiring plans become top priority on the to-do list. It is paramount to answer this question effectively to be able to attract and retain top talent. Equity is usually a good way to have everyone onboard however, if managed poorly, the company might suffer in the long-run. Simply put:

- If founders grant too little equity at pre-seed/seed/Series A stages, it might be hard to retain top talent over time. While there are tons of pros for joining an early stage startup, there are also some cons such as lower salaries, limited benefits, tricky work-life balance and less job security. If you ask me, allowing early key hires to own a fair % of a startup with a future higher value (hopefully!) is key to balancing out the potential risk-reward ratio.

- If founders grant too much equity early on, it increases the likelihood of creating an unbalanced cap table (VCs tend to not like messed up cap tables) and not having enough equity for future key hires (i.e. CMO, CCO, CPO, etc.) once the core team has been built. (Fred Wilson from USV wrote a great article on this topic). The usual (and bad) solution to tackle this problem is founders’ dilution to overcome this challenge.

The trick is finding the right % number to grant to each employee, which leads us to the key question: ”how to find the right equity % to grant when hiring a new employee?”

There are certainly different ways to answer this question and it undeniably varies according to countries (i.e. appetite for ownership) and schemes (i.e. tax, social contribution) in place (see Index’s great simulator to create option plan). The more straightforward and fairer option is using the base salary multiplier methodology.

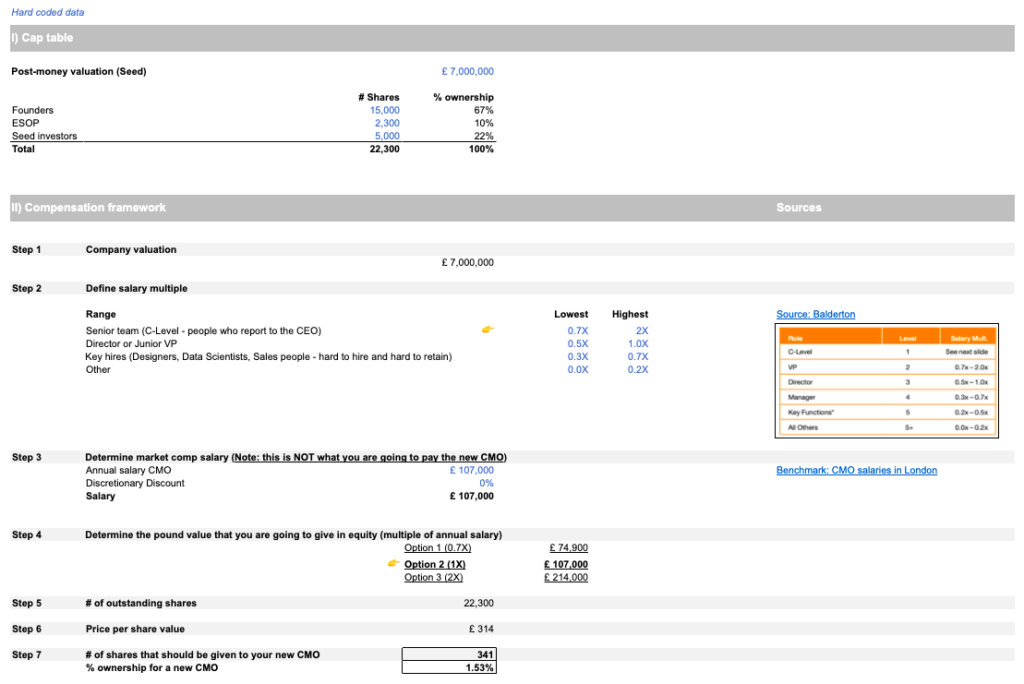

Let’s do a simulation to see how it works for a UK-based company that recently raised a seed round and has found the perfect CMO candidate. We need to input three variables to be able to come up with a final number of shares:

🧐 See simulation in Google Spreadsheet

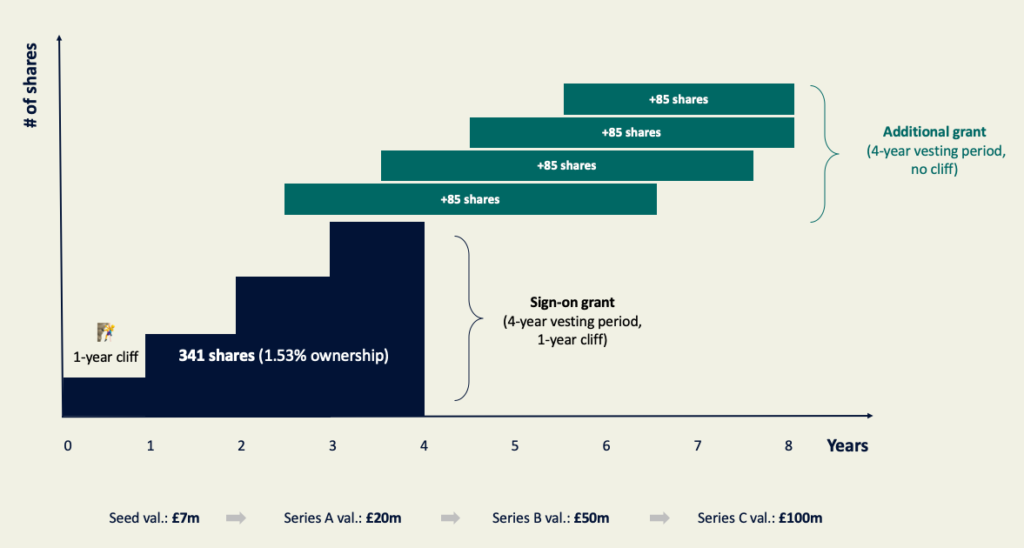

Now, we have the number of shares that should be granted the new CMO (341 shares for 1.53% ownership of the company), the remaining part is about communicating this number and defining the grant mechanism (i.e. usually a 4-year vesting period with a 1-year cliff). As Fred Wilson suggested, it is usually more efficient to focus on the total value worth of equity that the shares represent (£107k in our example) that is expected that this equity will grow by 3-5X over the next few years (£300-£500k) as the startup hits milestones, grows in value and potentially raises subsequent rounds of financing. (Note: Bear in mind that the strike price should be the lowest possible, so it is always better for the employee to receive the equity as early as possible.)

The additional benefit of this methodology is that it helps founders define the size of the ESOP and how much equity they should be issuing according to the hiring plan for the next 18-24 months. By doing linking the hiring plan to an estimated # of shares to be given to new hires, founders will be able to more accurately define the size of the ESOP.

For your hiring plan that involves recruiting a few key people over the next 12 months (i.e. CFO, CCO, CMO, CX Manager, etc.), knowing how many shares you are supposed to grant will make a big difference in your hiring strategy and the types of profiles that you will be able to hunt for.

Additional options to retain outstanding employees

There is an additional concept that is important to take into consideration, which is the evergreen option (please refer to the Wealthfront equity plan for more information). Under this mechanism, additional shares are issued to new hires, on top of the initial sign-on % granted.

In our example, the new CMO will get a total of 341 shares (1.53% as ownership) as initial grant, and on top of that the founders might decide to add new shares every year, starting after 2.5 years. The goal is to retain her over time and decrease the likelihood of her starting to look for new career opportunities in the next few years, right before her sign-on shares are about to vest.

Generally, additional grants:

- Are issued on a yearly basis, after 2.5 years in the company

- Are equal to ¼ or ½ of the initial sign-on grant. In our example, assuming a ¼ value, this would represent 85 shares (341 shares / 4) to be given as yearly refreshers to the new CMO

- have a 4-year vesting period without cliff

Sure, this mechanism implies additional dilution for the shareholders but I believe that it’s worth it because it reduces the risk of losing a key and outstanding employee. And of course, this mechanism only makes sense as long as the company keeps growing and increasing its valuation. The number of additional shares will also help reduce the dilution that the new CMO will logically experience during the future funding rounds (Series A, B, etc.).

In a visual way, this is what this mechanism would look like for our CMO.

Conclusion

In this short piece, I discussed the importance of finding the right # of shares to grant to new key employees, and I performed a simulation (7 steps) using a base salary multiplier approach in the context of a new CMO hire, which I believe is a fair and simple methodology. I also explored the concept of issuing additional shares on top of the sign-on grant for outstanding employees in order to retain them over time.

I hope that this piece has given one answer to the key question that many founders ask themselves: what percent % equity should I grant to a new employee?

As always, I would love to receive your feedback!